Our customers say Excellent![]()

Research and Development (R&D)

Tax Credit Scheme

What are R&D tax credits?

The Research and Development Tax Credit scheme is an initiative by the UK Government designed to reward small and medium sized UK enterprises investing in innovation and R&D. Companies can reduce their tax bill or claim payable cash credits as a proportion of their R&D expenditure.

They are a valuable source of cash for businesses to invest in developing their research and development activities, new staff recruitment and ultimate growth of the enterprises. R&D tax credits are the biggest single funding mechanism provided by Government.

If you are an SME you could receive a tax relief of up to 43.7p per £1 spent on qualifying R&D expenditure. If the company is loss making, you could still claim a cash grant of up to 33.35p per £1 spent on qualifying R&D expenditure.

How does R&D tax relief work?

If your company develops new products, processes or services or enhances existing ones, then you could be eligible for R&D tax relief.

There is a very wide scope for R&D tax credits and many business owners don’t think they’ll qualify, when they do! So don’t assume you won’t qualify for R&D tax relief, contact us and we’ll give you clear advice on your ability to claim.

Consider an engineering consulting company with 2 employees (including director), with a profit of £75,000. The company’s corporation tax liability (@19%) payable before the R&D claim is £14,250.

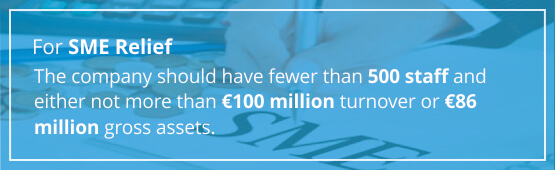

Out of its total expenses, business incurred £25,000 that qualified as R&D expenditure eligible for the small or medium sized enterprise (SME) R&D tax relief. Under the SME relief the qualifying R&D expenditure is enhanced by 230% and the relief works as follows:

Book a Free Consultation

| Profit before R & D tax relief | £75,000 |

|---|---|

| Deduct R&D Enhanced expenditure (£25,000 x 230% = £57,500) (Note: £25,000 was already deducted from the company’s profits). | (£32,000) |

| Revised Profits for tax year 31st December 2019 | £43,000 |

| Corporation Tax Payable (£43,000 x 19%) | £8,170 |

The company can save an additional £6,080 in Corporation Tax and received a relief of 43.7 pence per £1 of expenditure on R&D.

If the company was loss making company, it could surrender the loss to HMRC in exchange of 14.5% credit against the total enhanced expenditure. This means company could receive a cash grant of £8,337, which is equal to 33p per £1 of R&D expenditure.

With dns, With dns, you just have to contact us and then we’ll send you a questionnaire to complete and then you’re done! Our R&D tax experts will contact you and make the whole process easy and ensure you claim maximum R&D tax relief.

Who qualifies for R&D tax credits?

R&D tax relief can be available to businesses in all sectors. So don’t assume you don’t qualify. Book a call back today to get advice.

How much can you claim on R&D tax credits?

The government incentives to encourage investment in research and development are very generous and allow up to 33.35% of a company’s R&D spend to be recovered as a cash repayment or a reduction in Corporation Tax

What counts as R&D?

The scope for R&D tax relief is purposely quite broad. It doesn’t matter what sector you’re in or what size of business you run. If you’re attempting to ‘resolve scientific or technological uncertainties’, then you may qualify.

So, if you’re creating new products, processes or services or changing or modifying an existing product, process or service, then you should pursue a claim for R&D tax relief.

The research doesn’t need a successful outcome to qualify for R&D tax credits.

Is my business eligible for R&D tax credits?

- You should have a limited company in the UK which is subject to corporation tax.

- You need to be carrying out qualifying research and development activities.

- You have spent money on R&D activity.

R&D qualifying activities

HMRC guidance states that the for a project to qualify for R&D should be able to demonstrate that it:

- Looked for development or advancement in science and technology.

- There was uncertainty when the project was undertaken.

- How the project tried to overcome this uncertainty.

- The project couldn’t be easily worked out by a professional in a similar field.

What costs qualify for R&D tax credits?

- Employee costs: salaries, employer’s NI, pension fund contributions, and expenses reimbursed.

- Externally provided worker.

- Subcontracted expenditure costs.

- Costs of consumable items like materials and utilities.

- Payments to clinical trial subjects.

- Software directly used in R&D.

Important R&D points

- R&D Tax Relief is applicable to all sector and industries.

- You don’t need to be inventing something new, R&D can also be claimed if you are improving / modifying existing products or processes.

- You don’t need to be running a laboratory with professionals in white coats to be eligible.

- R&D is claimable even if the project fails.

- R&D tax incentives are available to SME and larger companies.

The benefits of R&D tax credits

R&D tax relief can transform your business by providing cash into your business to aid future growth or future research & development projects. They can give you an immediate source of cash to invest back into your business.

How dns Accountants

can help you?

- Future claim opportunities are identified, planned and developed.

- We work on a ‘Fixed fee’ basis.

- Minimum requirement of your time.

- We maximise the claim value by doing thorough review of your business.

- Claim activities are effectively co-ordinated and communicated both internally and externally.

- We have in-house technical R&D Tax experts, providing you trust and assurance that you are in safe hands.

- We deal directly with all the HMRC enquiries (if any) after the claim has been submitted.

Please get in touch with our R&D experts today to find out more!

BOOK A CALLBACK Call us on 03300 88 66 86Book a Free Consultation

Get in Touch

Get the best advice on R&D tax credits, tax savings, accounting and more, whether you want to call us directly, request a call back or chat online with our experts, rest assured that we will always give you the best advice.If you have any questions, or would like to speak to us in person, please do get in touch. We're here to help.

Head Office:

dns accountants

DNS House, 382 Kenton Road,

Harrow, Middlesex, HA3 8DP

Contact Number:

Email:

Other Offices:

- Aberdeen Accountants

- Barking Accountants

- Basildon Accountants

- Bournemouth Accountants

- Brighton Accountants

- Chancery Lane Accountants

- Guildford Accountants

- Harrow Accountants

- Haslemere Accountants

- London Accountants

- Maidstone Accountants

- Manchester Accountants

- Melksham Accountants

- Milton Keynes Accountants

- Nottingham Accountants

- Newport Accountants

- Romford Accountants

- Slough Accountants

- Southend-on-Sea Accountants

- Warwick Accountants

- Wigan Accountants

Limited time only!

Free Business Software

Say Goodbye to Bookkeeping Hassles: Nomi offers Free Receipt Processing and big savings!

- Built in payment solutions.

- Track profitability, debtors and creditors

- Snap pics of receipts with the mobile app

- Free Receipt Processing

- Hasslefree Bookkeeping

- Cost Reduction

Close