Built by accountants

just for you

There are huge benefits to forming a limited company,

here’s just a few of them…

more

liability

credibility

opportunities

opportunities

entity

See how dns can help

you today.

Need help with company formation from a friendly, no-nonsense team? Give us a call today on 03300 886 686 to speak to our advisors. We specialize in company registration in the UK, including limited company formation, private limited company registration services, and LTD company formation. We'll help you register your limited company and give you access to a wide range of other benefits.

Trusted reviews

Our goal is to provide the best service to all our clients, all the time.

Read what our clients say about us.

I am writing this email as a token of appreciation for Manish Garg, who is our lead accountant for the past...

Read moreWe work with DNS Associates for 4 years now and we always had a feeling that our problems and questions are top...

Read moreDNS Associates provides cost effective and very professional services. My accountant Sneha Gurudutta has been...

Read moreVery professional and efficient team. I will highly recommended to all small or big business owners...

Read moreI’m a new client and Debangshu Sarkar has been reliable, timely and informative to date. Very impressed...

Read moreExcellent services, my account manager Amit Gupta always there for me, excellent work on time and take...

Read moreI recently starteed my own company and in need of a good accountant. With my friends reference, I started...

Read moreI have been using DNS Services over a year from setting up my company till date. They are extremely professional...

Read more

To set up a limited company you need to register with Companies House. This is known as 'incorporation'. dns can take care of all the formalities and help you register your company with Companies House without any hassle.

You will need the following details for every person who is to be appointed as a director or Shareholder of the company to place your UK limited company formation order request:

- Full name (including middle names - not initials)

- Residential address including postal code

- Date of Birth

- Nationality

- Business Occupation

- Passport or national identity card number*

- Telephone number*

- Town of birth*

*These details are required to create an electronic signature for each person and contribute towards our Anti-Money Laundering checks. This information is kept confidential, and only three digits or characters of each of these are submitted to Companies House as part of the electronic signature.

In general, you can use any company name. The name must end with the word 'Limited' or its abbreviation 'ltd'. But there are rules on what it can and can't include. Also can you prepare your own limited company accounts? Have detailed information here.

First and foremost, your company name should be unique and should not be 'similar' or 'same as' an already registered company. To check this, you can search the Companies House register

Your name also can't:

- Contain a 'sensitive' word or expression

- Suggest a connection with government or local authorities

- Be offensive

A company can have any number of shareholders. There must be at least one shareholder, as a company cannot exist without a share capital. There is no limit to the number of shares that can be held by an individual.

Also have some information about benefits of forming companies in a group structure.

After registering your company with Companies House, you will receive the following documents: Memorandum of Association

- Statement of Capital

- Articles of Association

Yes, you can set up your own company by following some guidelines on the UK Government’s official website. However, the process is tedious and time-consuming. Getting an expert to help you with your company formation process may smoothen everything. We have the right company formation package for the incorporation of your company! We guarantee you a hassle-free process! You can also compare the company registration package here.

Well, there are many substantial differences between a limited company and a sole trader. If you are still deciding which one to opt for, you’ll have to first understand the basic differences between them to figure out what suits you best. Our blog article: Sole trader vs limited company: what's the difference? will give you more clarity, and definitely help you take that call.

Once you have decided on your company name, you can visit our official website: dns accountants, where we provide online accounting solutions to contractors, freelancers, startups and small businesses. You can then begin a simple process of forming your limited company with our online application.

A certificate of incorporation is an important legal document that is required during the company formation process and issued by the UK government. This certificate of incorporation is also commonly referred to or labelled as a license to incorporate a limited company.

Including the complexity of the company structure and the efficiency of the registration process, to register a company in London wholly depends on several factors. On average, the company formation London process typically takes between 24 hours to 10 days. However, with the assistance of professional service providers specializing in company formation London, the registration process can be expedited. These experts ensure compliance with legal requirements, handle paperwork efficiently, and facilitate a smoother registration experience. Their expertise and knowledge of the local regulations can help streamline the process and reduce the registration timeframe.

When you're setting up a limited company Birmingham structure, there are two key documents you'll need. Firstly you will need the Memorandum of Association and the Articles of Association which included a few important details like your company's name, registered office address, and shareholder information. However, the Articles of Association lay out the internal rules and regulations that govern how your company operates, covering things like share capital, voting rights, and director appointments. These two documents are essential for a smooth limited company formation Birmingham process. To ensure everything is done smoothly, it's recommended to seek professional guidance or use company formation accountants.

Still have questions?

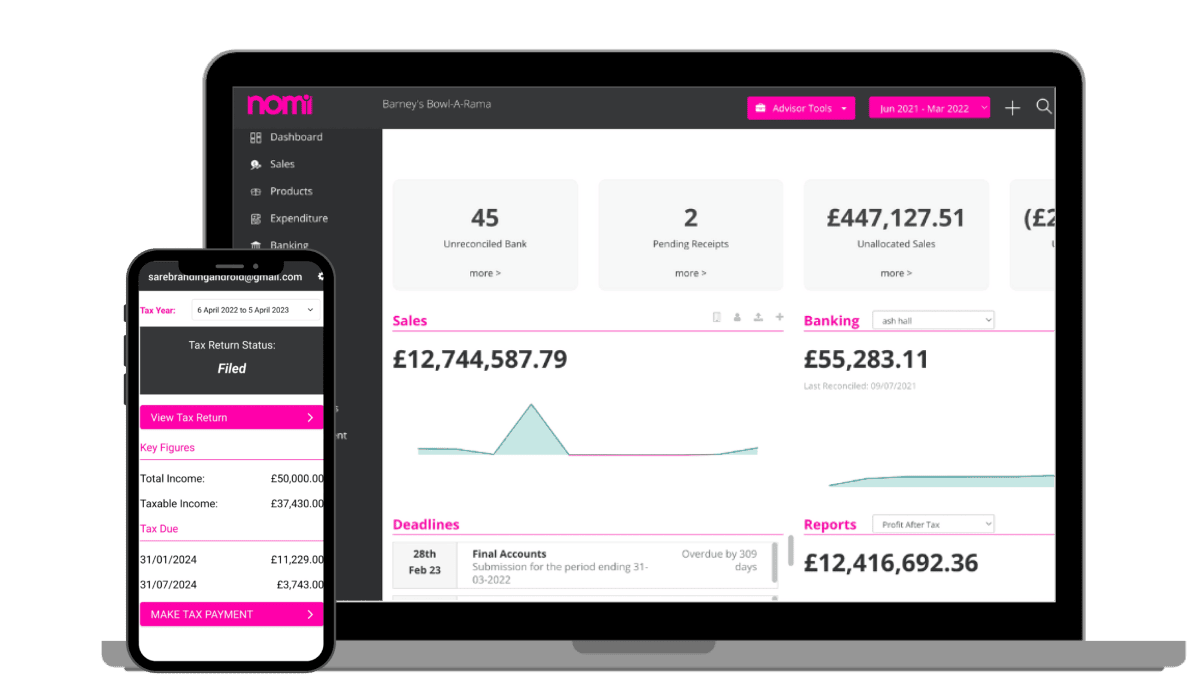

Free Business Software!

Limited time only!

Free Business Software

Manage your business remotely with our free cloud-based accounting software. Designed for UK-based business owners.

- Built in payment solutions.

- Track profitability, debtors and creditors

- Snap pics of receipts with the mobile app

Close