Form 17 is the form that associated with the property tax in the UK. Through this article you will come to know some of the uniqueness in filling the a form 17 declaration as an owner of a joint property and income

It is a general assumption in many of the married couples who are owners of jointly rented properties that their legal responsibility is complete if they have declared their income on one of the individual tax returns.

However, experts in accounting and taxation have a different say that, this assumption by married couples is certainly not correct.

The fact is, if the income is irregularly split, it becomes necessary for the taxpayers to fill the form 17.

The article is based on the queries generally put forth on the basic requirements of form 17.

What are the Types of Property Ownership?

Two types are there in which a property can be owned by more than one person:

Joint tenants

In this each member is supposed to hold an equal share in the property. Therefore if there are three joint tenants then all three will be eligible for a third share of the income or gains that arise from one property.

In case one of the owners die the property is incontestably transferred in equal share to the other joint tenants and none is allowed to sell the share they own without the permission of the other.

Even if the deceased openly leaves a will mentioning his share to someone else, the legal rights of the parties that survived to a joint tenancy overrule a will.

The legal understanding is that whatever the procedure be, if sale of the property takes place then the income or capital gain earned from it will be shared equally amongst the tenants, no matter what the percentages each party might have in fact contributed in purchasing the property and/or even in the maintenance of the property or mortgage.

It is a common belief that when you decide to purchase a property jointly, it is nothing but making a gift of an additional contribution to the partner in the tenancy.

Tenants in common

In this type the share of each property owner is separate. The share can be unequal too and can be sold or gifted to anybody in a lifetime or on death, as per the wishes of the owners.

Either as joint tenants or as tenants in common is a property ownership type that can be owned by two or more unmarried people; however it is more natural to be accepted as tenants in common. The property ownership that is in default position by spouse or civil partners is accepted as joint tenants.

There is a possibility of joint tenancy to be changed into tenancy in common ownership at a later stage; however, tenancy in common can not be change into join tenancy.

Position of Tax for Different Types of Owners

Form 17 for Unmarried owners

In case of unmarried parties holding a property or owned by business partners, the tax that is followed is the beneficial ownership (that is who paid higher deposit, borrowed bigger credit for property purchase, etc.) instead of legal ownership (that is whose name the documents hold including the deed).

However, the above criteria do not fit suitable for rental incomes, so the allocated profit and loss from rental incomes must not be in the same ratio as the principal beneficial ownership.

As an alternative, the partners or owners can agree on different share as they find suitable, the share refers to profit and loss only and not essentially in case of capital gain received when the property be sold.

Whatever the situation be, Form 17 is not relevant for the unmarried partners or owners of joint property in whichever way they hold it.

If you are Married owners – How significant is Form 17?

According to the tax law (s836 ITA 2007) for rental profit earned from property owned by the spouse or civil partner jointly is liable to tax of 50:50 regardless of the underlying individual percentage of each owner. But this doe not relevant to property owned by partners within business partnership.

By the way, there is a false impression that all you have to do is filling and submitting the Form 17 to HMRC and the profit earned from the jointly owned property is taxable at a different ratio of default 50:50.

If as per the income tax purpose it is found efficient to divide the profit separately, then the profit can be split as per the beneficial ownership.

This kind of uneven ownership is seen only in tenants in common and this is the time when Form 17 is found relevant.

The form has to be signed by both the partners jointly, if one of the spouse or civil partner choose not to sign then both has to agree to the standards of 50:50 split by default.

This form is relevant between only two married couples or civil partners living together.

As the HMRC is informed whatever the proportion be it remain intact till the beneficial interest of the couple in the property changes or one of the couples/partners dies or start living separately and do not continue as married couple or civil partners.

The Form 17 has to be filled and submitted with 60 days from the date of announcement and it can not be backdated. The time limit is fixed and there is not possibility of extension.

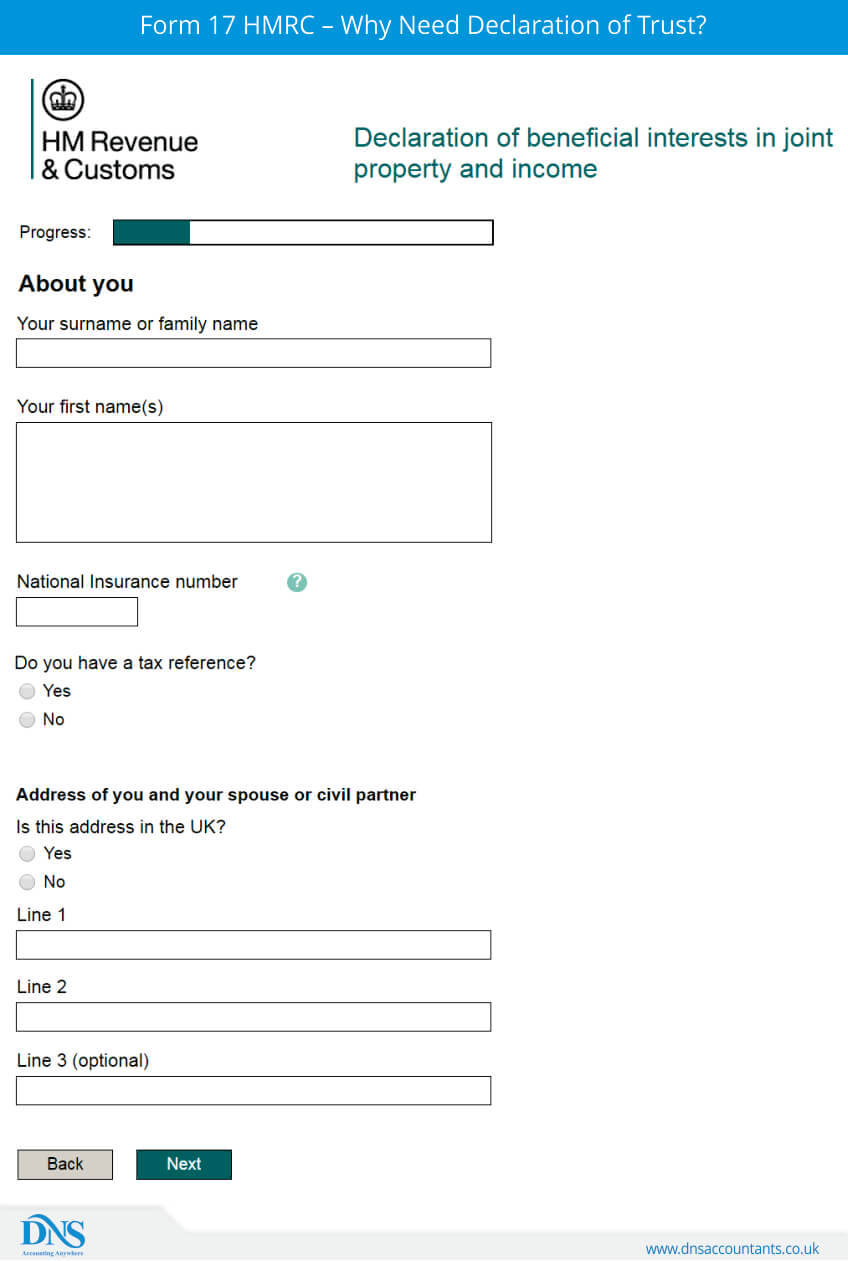

Why one needs a declaration of trust?

A particular share of an owned property by tenants in common does not come on the title of the deeds of the property.

Therefore, under what term the amounts are owned by each individual is recorded in a formal document, which is known as a “declaration of trust”. This declaration is then given consent by all parties by signing on it and then the record of the same is maintained on the property register at the Land Registry.

The document of evidence that has record of property shares being owned unevenly must be sent to HMRC along with the form 17 for submission.

The declaration of trust that costs in the region of £300 can be obtained from a solicitor for a strongest proof of evidence.

Points to Ponder on

What is the Position of Capital Gains?

In whatever the income tax purposes treat rental income, it is the primary beneficial ownership that decides the treatment of the capital gain tax.

For that reason the proportionate share must make certain that the full CGT allowance can be share equally amongst both the owners for equal use.

This case is not suitable for a married couple who in the beginning had agreed on a split of 90:10. Hence the declaration of trust will require amendment ideally few months before the actual sale of their property.

This way HMRC will get enough time to document the needed amendments. CGT disposal is transfer of favourable interest from one partner/spouse to another.

However, though it is not likely to produce a profit by virtue of the ‘no gain/no loss’ rules, there might be an agreement when the property is sold at the end.

Any questions? Schedule a call with one of our experts.

_(2).png)