Accounting anywear

Whether you're a small business owner, landlord, contractor, freelancer, startup or non-resident, our ethos is

accounting anywear. So whatever you wear, whoever you are, wherever you are, we're here to help.

Online and in person.

limited company

Expert support for your limited

company's accounting needs

with additional free* will benefit

contractors

Simple accountancy solutions for both

contractors and freelanceras

small businesses

Small business accounting requires accurate

bookkeeping & maintaining business's

financial transactions efficiently.

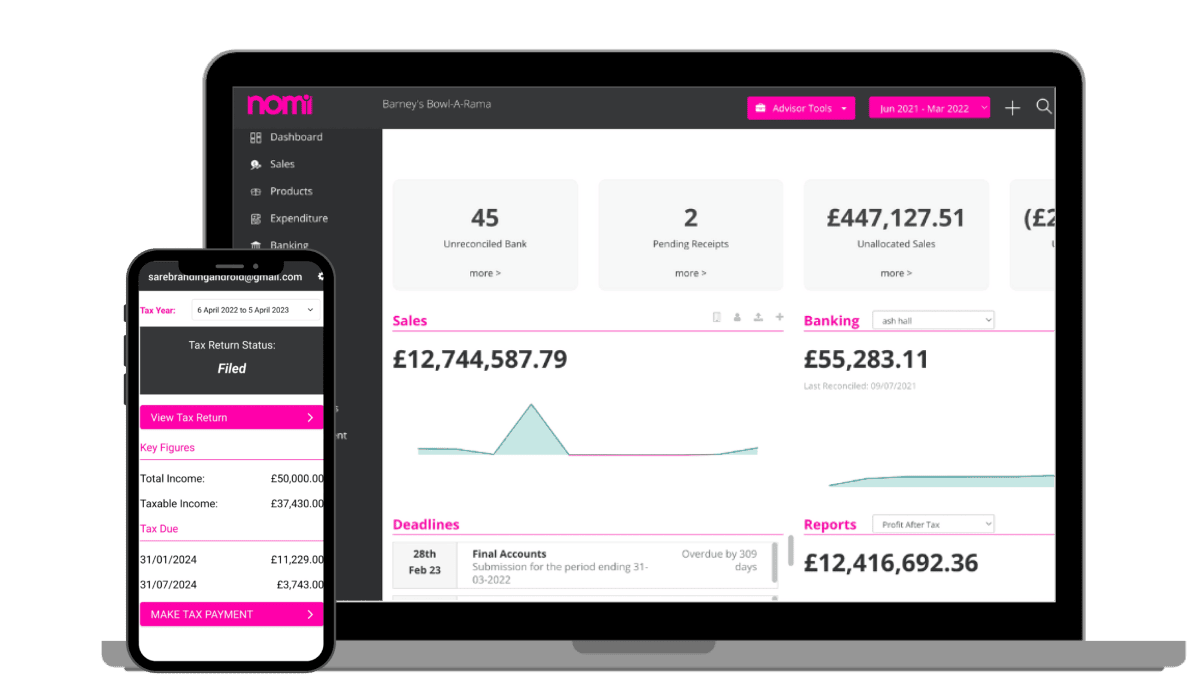

Free Business Software!

Manage your business remotely with our free cloud-based

accounting software. Designed for UK-based business owners.

Get paid via cards

and direct debit

Create sales

invoices

Snap pictures of

receipts using the

mobile app

Connect your bank

for easy reconciliation

Track your debtors

and creditors

It’s yours for free!

Worth £240 per annum