Uniform Tax Rebate Form p87

To get refund on tax while maintaining or buying your uniform, an employee has to fill form p87 to get tax refund on uniform. Form p87 is the form for ‘Tax Relief for Expenses of Employment’ which can be filled online and offline as well. You can download and take printout of form p87 below.

This form can be filled online by signing in to Government Gateway or by downloading the form and sending it through post.

ALSO READ: How to Claim Uniform Tax Rebate

How to fill form p87?

Form p87 can only be filled by employees, whose allowable expense does not exceed £2,500. Below are the steps on how to fill the form-

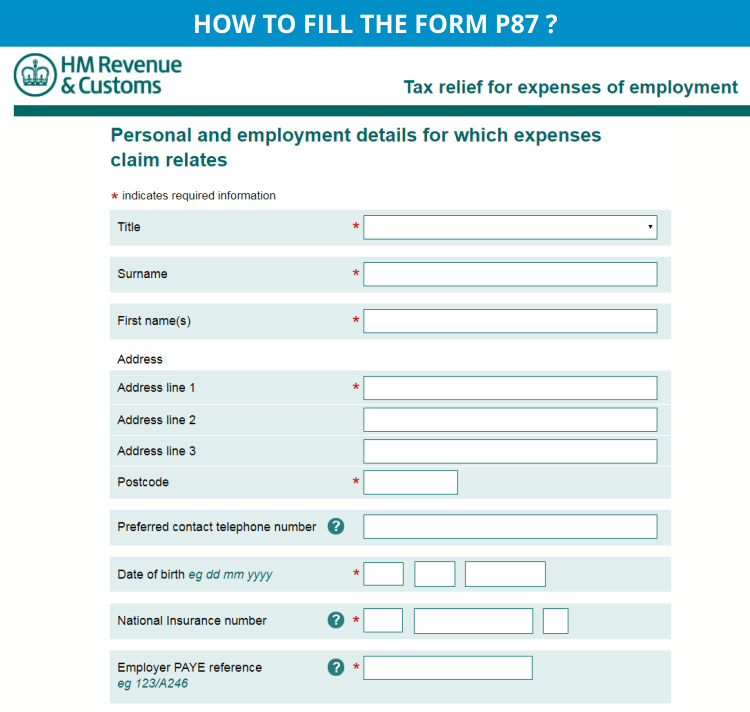

1st Page – Employer Reference Number, National Insurance Number, Personal and Official details. The first page is all about filling up the basic details.

2nd Page – Provide flat rate expense for maintaining or buying your uniform. If you wish to claim more than the flat rate (usually decided in an agreement between the union/employer), then click No and provide the details of your expenses like keeping the invoices.

3rd Page & 4th Page – Provide all other expenses like vehicle, car mileage, professional subscriptions and other general expenses. Provide other details like how you wish to receive the payment and total expenses being claimed.

ALSO READ: Calculate Tax Rebate on Uniforms

Where to send form p87 offline?

Pay As You Earn

HM Revenue and Customs

BX9 1AS.

Post submission of the online form, you get a reference number which you can use to track the progress of your claim. Normally, it takes around five weeks for the claim to get processed after HMRC receives your completed form.

Any questions? Schedule a call with one of our experts.

.png)