If you let out a property in the UK and you are UK non-resident or you are a UK resident that lives...

READ MORE

What we do

What’s included in your self assessment tax return?

Make your tax return process quick and efficient with the dns accountants. We help you with:

- A UK-based tax return accountant to fill your returns

- An expert advice to claim eligible expenses and tax reliefs

- Current or previous tax year filing

- Calculation of tax bill

- Tax return filed to HMRC

- Support to save on your tax bill

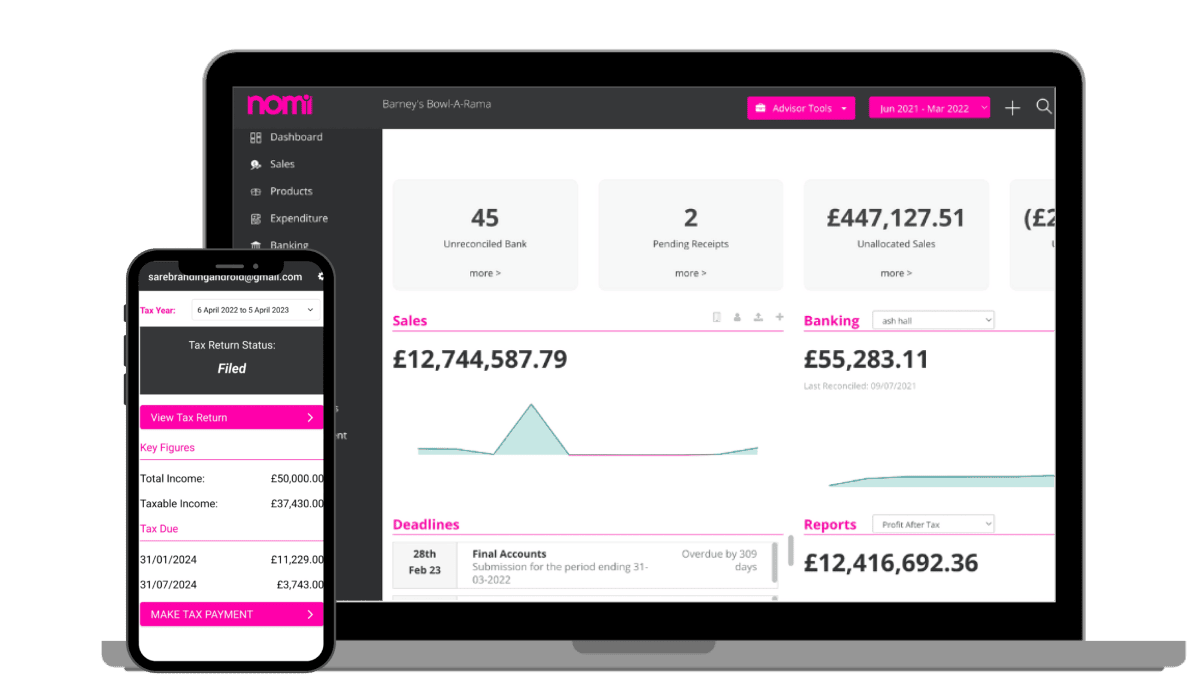

Free Business Software!

Manage your business remotely with our free cloud-based

accounting software. Designed for UK-based business owners.

Get paid via cards

and direct debit

Create sales

invoices

Snap pictures of

receipts using the

mobile app

Connect your bank

for easy reconciliation

Track your debtors

and creditors

It’s yours for free!

Worth £240 per annum